01 Loan type

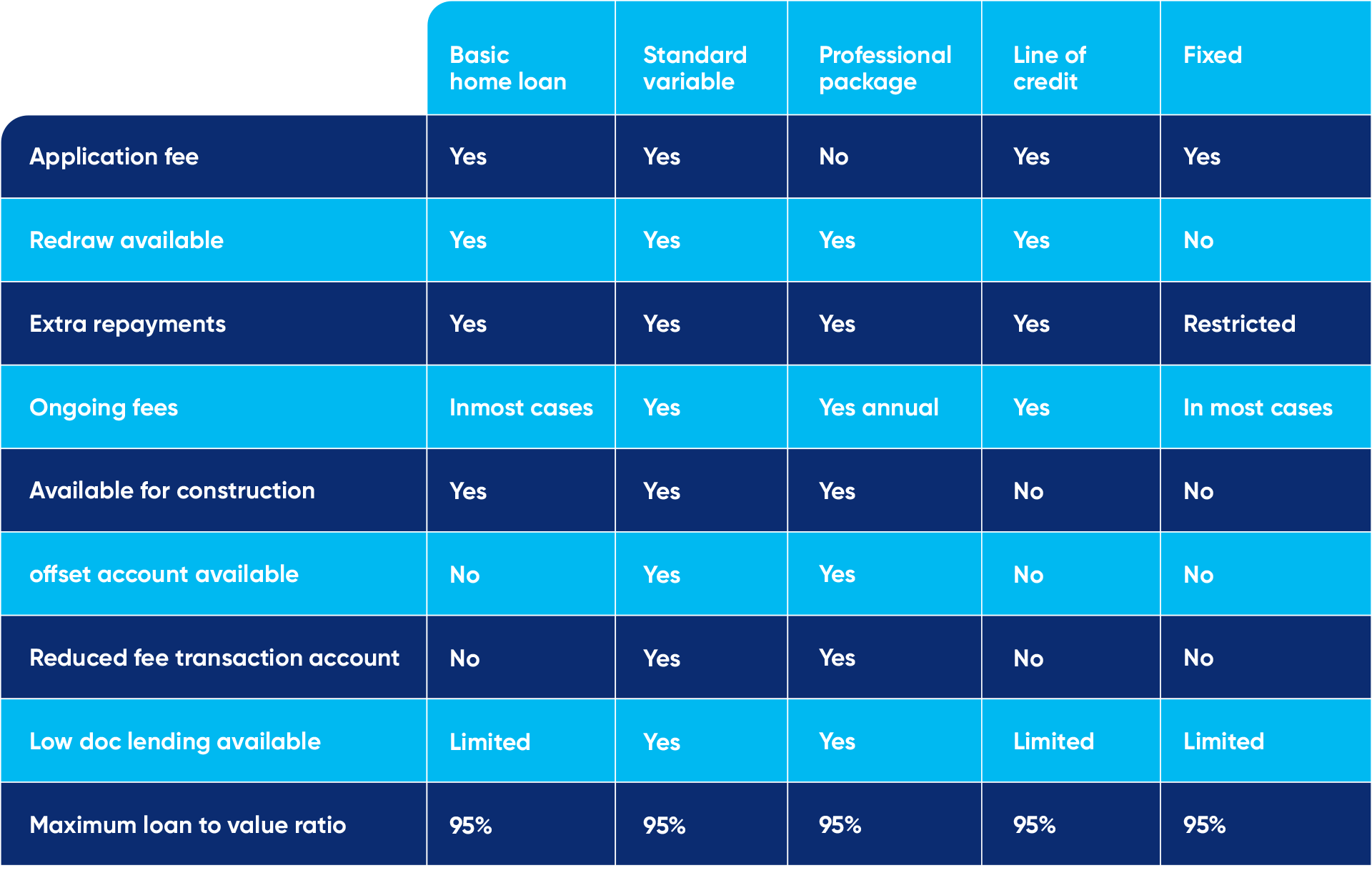

Basic Home Loan

The Basic Home Loan is one of the most popular loans. It has the lowest running costs and less extras – so you can pay a lower interest rate.

The Basic Home Loan is one of the most popular loans. It has the lowest running costs and less extras – so you can pay a lower interest rate.

02 Loan type

Standard Variable

This is the most common home loan. It is usually at the lender’s standard variable rate, and usually offers numerous features.

This is the most common home loan. It is usually at the lender’s standard variable rate, and usually offers numerous features.

03 Loan type

Professional Package

A Professional Package offers you interest rate discounts depending on the loan size. It offers fee free transaction accounts and credit cards free of charge and a range of other social offers. It is a misnomer that the Professional Package is just for professionals! This is not the case. In fact, the only requirement you need to access these loans is to meet the lender’s minimum loan amount (which can start at $100,000)

A Professional Package offers you interest rate discounts depending on the loan size. It offers fee free transaction accounts and credit cards free of charge and a range of other social offers. It is a misnomer that the Professional Package is just for professionals! This is not the case. In fact, the only requirement you need to access these loans is to meet the lender’s minimum loan amount (which can start at $100,000)

04 Loan type

Line of Credit

With this type of loan, you can access funds up to your approval limit at any time. Your salary can be paid directly into the loan account and you can access the balance of the loan at any time – like a credit card. You can use these funds to purchase shares, go on a holiday, buy a new car, start home renovations and much more!

With this type of loan, you can access funds up to your approval limit at any time. Your salary can be paid directly into the loan account and you can access the balance of the loan at any time – like a credit card. You can use these funds to purchase shares, go on a holiday, but a new car, start home renovations and much more!

05 Loan type

Fixed

A Fixed term home loan has a pre-determined, set in mortar interest rate for a set agreed upon period of time. Fixed interest home loans provide you with the security of knowing exactly what your repayments will be for the duration of your mortgage agreement.

A Fixed term home loan has a pre-determined, set in mortar interest rate for a set agreed upon period of time. Fixed interest home loans provide you with the security of knowing exactly what your repayments will be for the duration of your mortgage agreement.

Discuss your options

Get in touch.

Would you like to speak to one of our MFAA accredited financial specialists? Submit an enquiry and we’ll be in touch shortly.

Book A Call

Contact Us