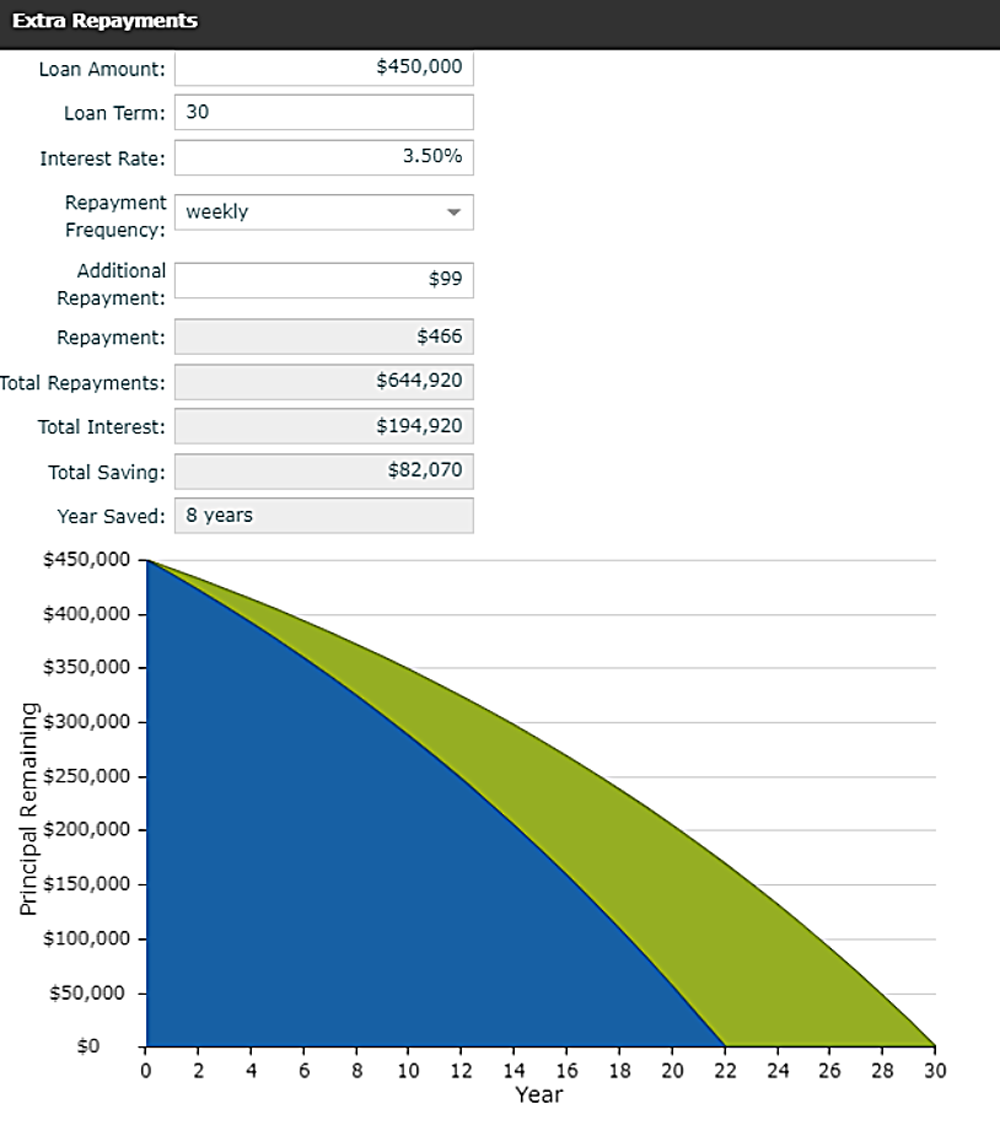

Did you know that by paying as little as an additional $99 a week, you can actually save over eight years on your home loan?

*This is based on a loan of $450,000 at 3.5% per annum over 30 years.

How do you actually go about saving $99 per week?

1. Budget

Start with a budget. Find out where your money’s going and where you might be able to cut back and push some savings from your transaction account into your home loan.

2. Set up automatic payments

Once you’ve identified any savings you can put toward your home loan, set this up as an automatic recurring payment. You can do this through your internet banking so that it occurs every week or every month on the day that you’re paid.

It’s really important to get that extra money going across to your home loan the day that you’re paid so that once it’s set up you won’t have to think about it and you can continue spending as normal. If you can keep this going, you’re going to have massive savings. And in this instance, be able to clear your mortgage eight years earlier.