Have you ever wondered how you access the equity that you want to use towards renovating your home?

Or what banks look for when assessing your application and deciding how much you can borrow to use for renovating your home? It's important to note that there are two different categories that you may fit into when looking at renovating. See below for our breakdown and examples of each category.

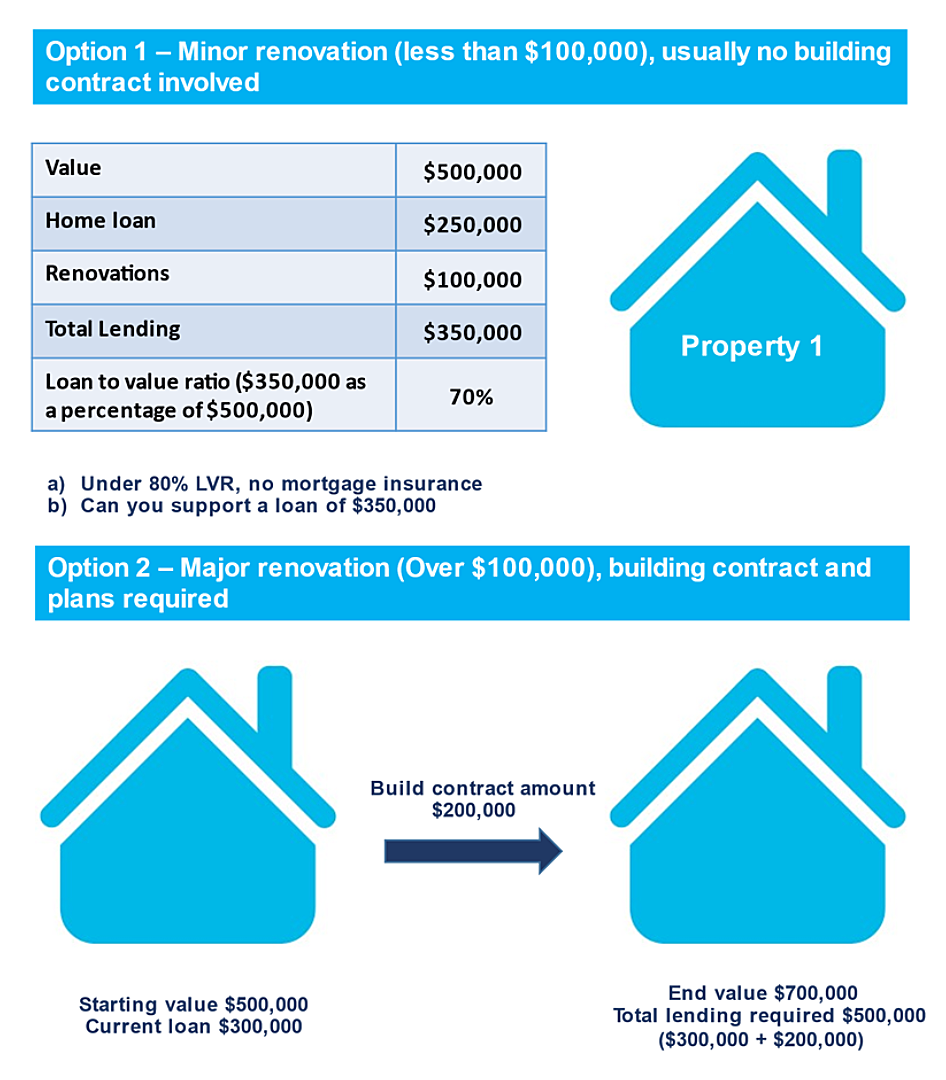

Category 1 Example

The first category is a minor renovation, when the amount you need to borrow is usually less than $100,000 and the renovations are what the bank would refer to as non-structural. In the example below the property is valued at $500,000. The banks can lend up to 80% which is $400,000, less the existing home loan of $250,000.

The individual is looking to borrow $100,000 for renovations therefore the total amount of the loan is $350,000 which is below the 80% mark. In this case, if that person meets all the other criteria, the bank would allow them to use those funds for a minor renovation.

Category 2 Example

If you are wanting to borrow more than $100,000 to do renovations on your property, you’re likely to fit into the category of a major renovation or a major construction line as thank banks refer to. In this instance, it’s likely you’re going to have a building contract involved as well as engaging a builder to perform the work. The bank is then going to value the property on what it’s going to be worth after the renovation is completed, as opposed to the minor renovation where they’re going to work on what the property is valued at that current time. The banks are going to work out, “What’s the property going to be worth when the work that the builder is doing is completed?”.

The other important thing to note is that the bank is going to control the payments. The builder will do each stage of the work, and after each stage, they will invoice the bank for payment and that bank will then make that payment directly to the builder. The bank won’t be giving you access to the funds, rather they will be controlling the funds, which is why they’re comfortable in taking evaluations when the work is done because they’re controlling the process.

If you are looking to renovate, think about which of the above two categories you may fit into.