Let's talk about offset accounts.

Are you aware of what an offset account is? And do you know if it's actually worthwhile having one?

An offset account is something that most banks will offer for you with their variable-rate home loans. But the majority of them come with an annual fee of around $395 a year.

So, how do you know if it’s worthwhile paying that fee and getting the offset account?

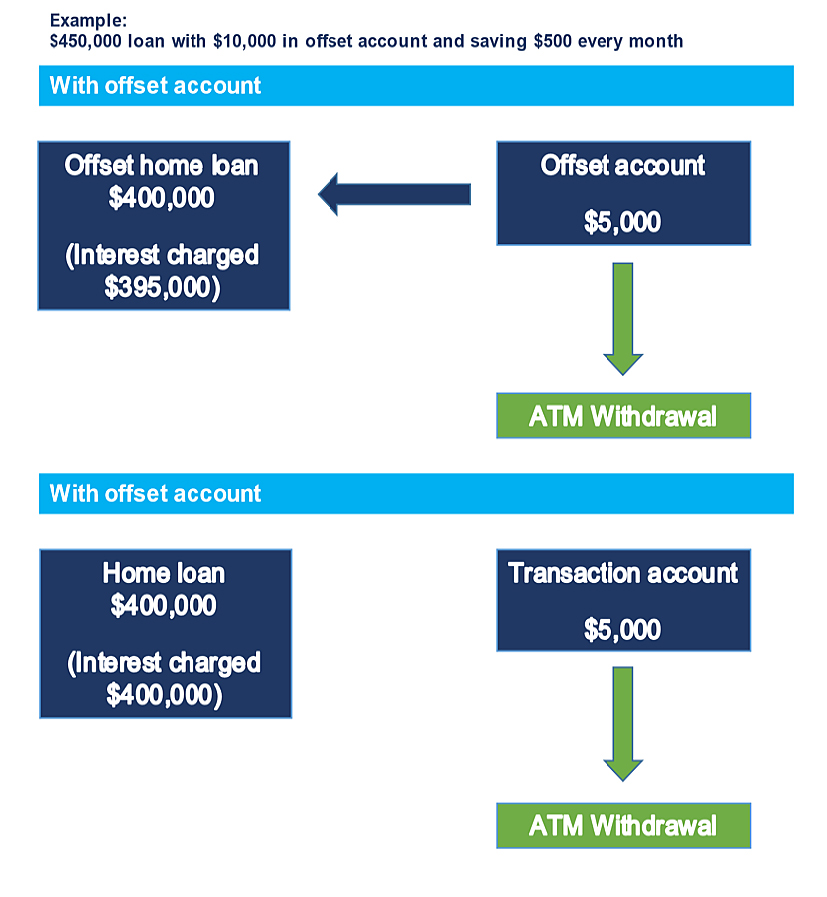

Example:

In this example, you’ve got a $400,000 loan and $5,000 sitting in your offset account. In this case, you’ll only pay interest on $395,000. Based on the fee of $395 a year, you actually need approximately $10,000 in your offset account, at an interest rate of around about 4% to save $395 in interest.

On the other hand, basic home loans don’t have an offset account with them and usually don’t come with an annual fee. So, you can have a basic home loan without an offset account with no fee. In this instance you would just manually move money across to your home loan.

For example, If you accumulated savings of $10,000, you can move that money into your home loan at any time. So, is the offset account worth it? Well, it’s going to depend on how much savings you’re building up and what the interest rate is for an offset home loan.

Once you work through those calculations, you’ll be able to work out if it’s worthwhile for you.