Do you have multiple debts in place and you’re not sure which one to pay off first?

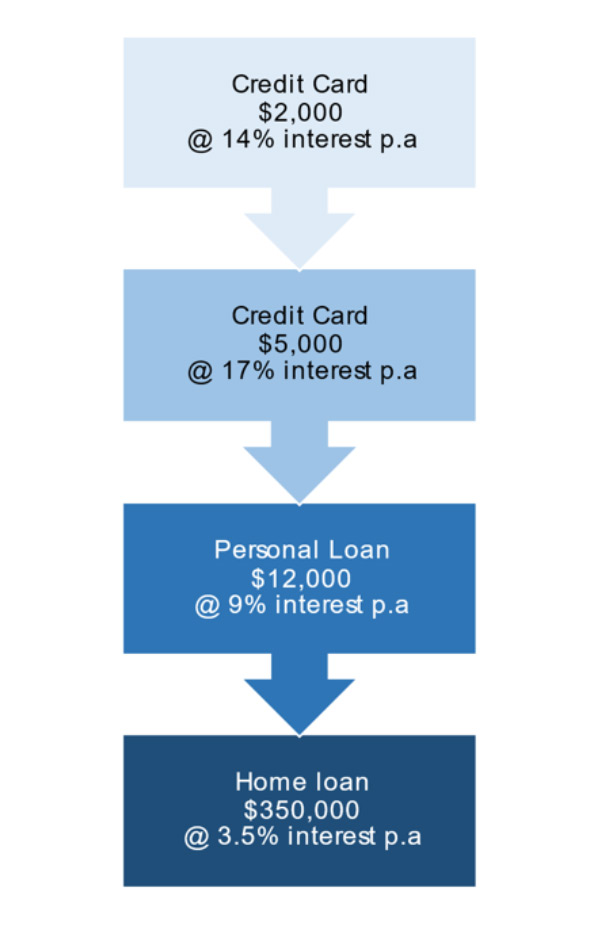

In this example, we look at someone with multiple loans including:

Credit card A - $2,000, Credit card B - $5,000 at a higher interest rate of 17%, Personal loan for $12,000, Home Loan

So, which one do you attack first? One strategy might be to try and pay off the loan or the credit card that has the highest interest rate. And that may work very well for some people, but what we’d actually suggest is attacking the loan or the debt facility (credit card) that has the smallest amount owing.

By doing this it’s going to give you a sense of confidence that you’re making progress. This method is also going to make it feel much more achievable by clearing a debt that has the smallest amount owing compared to the other facilities you have in place.

Start by getting the smallest debt removed then move on to the next debt or credit card that has the lowest balance from your remaining facilities. Progressively work your way through the debts until you’re hopefully in a position where you’ve got just your home loan remaining, and you’ve got surplus income to try and hit that home loan and get it down as fast as you can.

This is called the snowball effect, and we really hope that you can put it in place if you’re in a situation similar to this one.