Are you aware of how banks actually work out how much you can borrow?

This is the process the banks go through when looking at your application and establishing how much they are prepared to lend to you.

1.

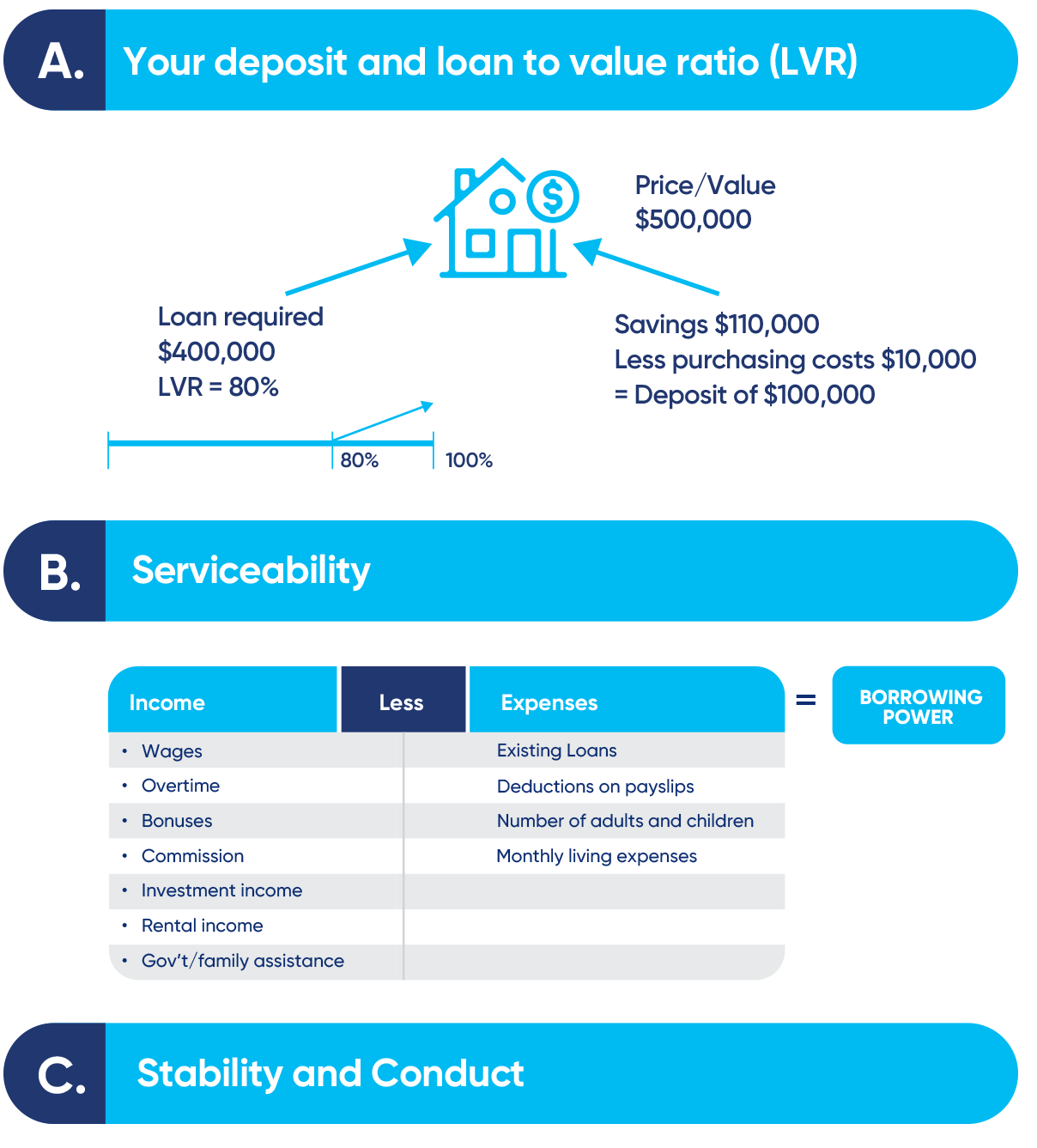

The first step is the loan-to-value ratio. What does that mean? Well, it means that the bank is deciding how much you can borrow based on the property value and the deposit you have. Using the example below, if the property is valued at $500,000 and you have $100,000 to contribute, you need the bank to bring $400,000 to the transaction, which is a loan-to-value ratio of 80%. (If you require more than 80% the bank will charge you mortgage insurance, which is added to the loan).

2.

The next section the bank will go through and work out, based on your application, is your borrowing power or your serviceability. That is how much can you afford each month to go towards a mortgage repayment, once the bank takes into account your income, the number of adults and dependence in your home, and any existing loans that you have, as well as your living expenses. Once all this is taken into account, the remaining amount is what can be allocated to mortgage repayments.

3.

And thirdly, your stability and conduct. How long have you been in your job? Do you have any overdue debts, and do you have any defaults or judgments on your credit file?