Are you looking to access the equity in your home to use for an investment, a holiday, or maybe for something else?

This is how the banks assess whether they will lend you money based on the equity you have and what it will be used for.

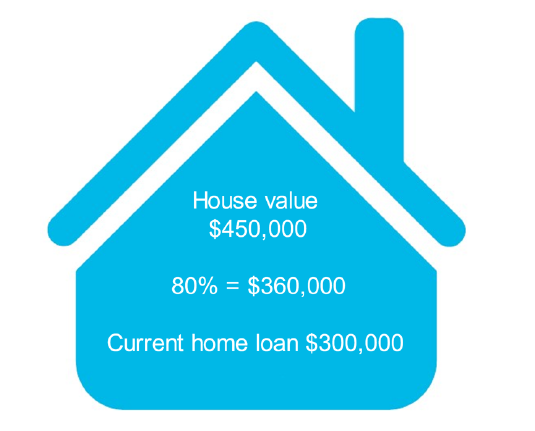

Looking at the following example, we’ve got a house valued at $450,000. Most banks will allow you to access up to 80% of that value without mortgage insurance. So, if your current home loan is, in this example, $300,000, the bank will allow you to access equity of $60,000.

What are the types of expenses the bank will allow you to use that money for?

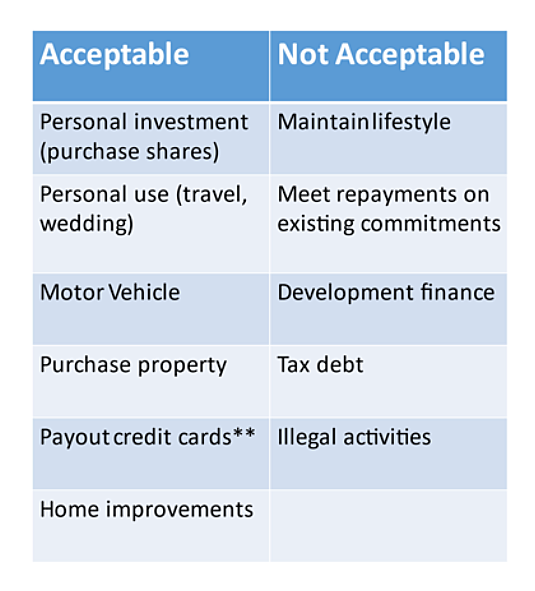

Acceptable items would include Personal investment, investing in shares, personal use such as a wedding or traveling overseas, a motor vehicle you may wish to purchase, another property that you may wish to use those funds for, or higher credit cards.

For credit cards, the bank will often want to see the statements on those credit cards to make sure that you’ve been paying them on time and to see how much is owed.

It can be difficult to obtain money for paying off credit cards if it is quite a significant amount (over $50,000).

Finally, home improvements and any sort of renovations you're looking to do are usually acceptable, especially if it's fairly minor.

Things that are unacceptable to use money in your home for are things such as maintaining your lifestyle as the bank expects that you can do that with the income that you’re earning, meeting repayments on existing commitments you have, any sort of development, finance, or investment in a business they’re likely to ask a lot more questions about and maybe refer you to the business section of the bank, covering a tax debt, and finally, any sort of illegal activities.