Do you have all of your bills and spending coming out of the one account?

If you do, you may find it difficult to keep track of your spending, which is a really common problem for a lot of Australians.

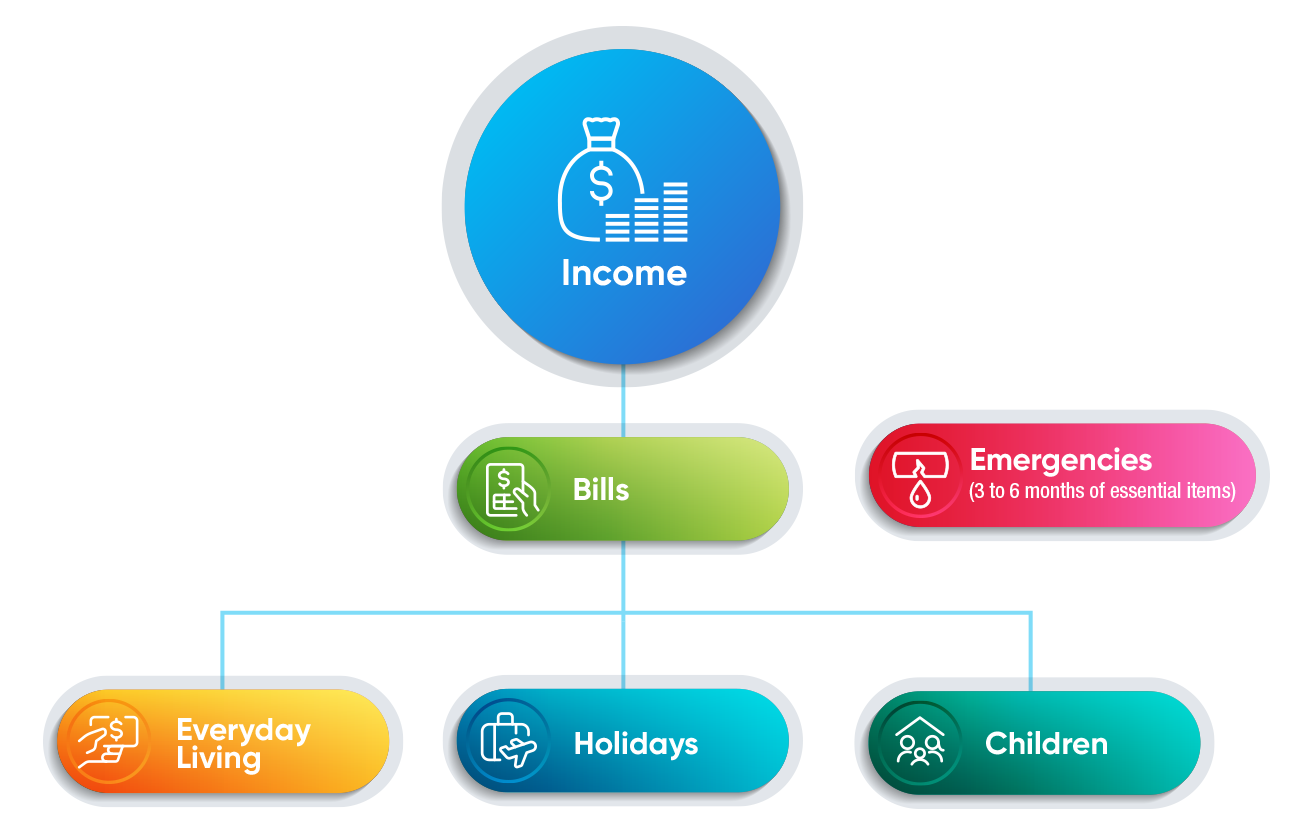

One way to try and make it easier for you to track how much you’re spending each month, is to actually separate your bills from your everyday spending. Bills being anything that is a direct debit, or paid via BPAY, as opposed to things that you pay with cash or tap and go.

Which fits in which categories? Items you want to allocate to your bills account include any home loan or other repayments, utilities, phone and internet, insurances, also things like gym memberships and any direct debits, which have the same amount coming out each month.

These are the sort of things you want coming out of your bills account, because they’re fixed, and you know how much they’re going to be.

The next step is to create a different account for your everyday living expenses. This includes things like groceries, fuel for your car, transport, eating out, coffees, lunches, entertainment, clothing, hobbies. You can then set up additional separate accounts for items you want to save for such as holidays or children.

What works really well, is if you actually have your income being paid directly into your bills account, and then give yourself an allowance each week for those items that you’re using your card for or saving for. That way you can track exactly how you going each week managing your spending.