A STEP BY STEP GUIDE TO USING EQUITY TO PURCHASE AN INVESTMENT PROPERTY

How do you use the equity of the home you're living in towards an investment property?

Step 1 – Find out how much equity you have

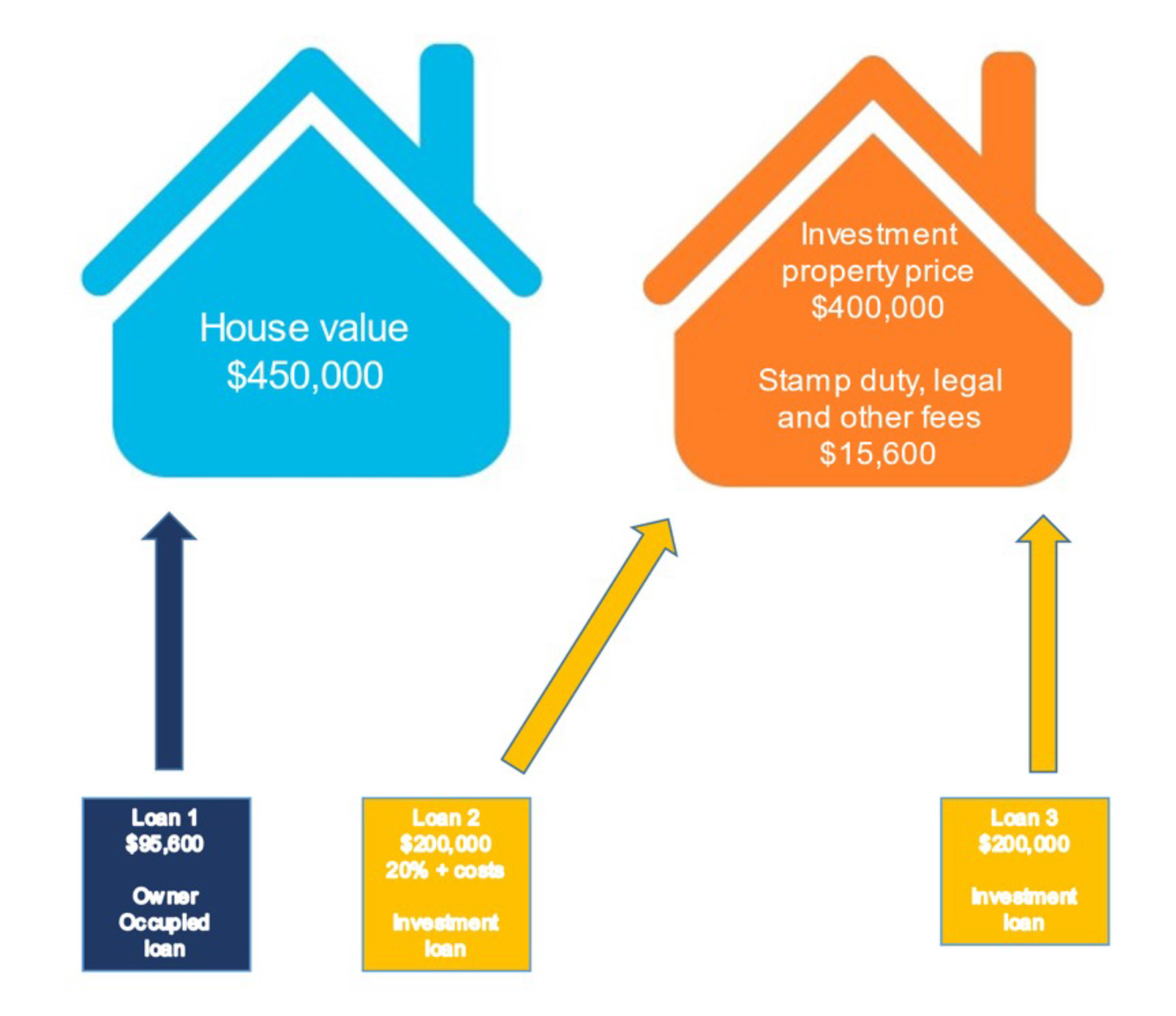

Using the example below, a house that someone is living in is valued at $450,000, without mortgage insurance, the bank will allow you to access up to 80% of that, which is $360,000. The current loan is $200,000, so there’s $160,000 worth of equity available to use for investment.

Step 2 – Set up a loan for the deposit and costs of the investment property

In this case, the investment property is valued at $400,000.

You will need to access a deposit of 20% of the property value plus the stamp duty and purchasing costs that are involved. That is a total amount of approximately $95,600 (based on an investment property in Queensland).

Step 3 – Set up another loan

This loan will be your third loan and it goes towards covering the remaining funds that are needed for the investment property.

The first loan is your personal home loan, the second loan is for the deposit on the investment property, which would need to be with the same bank, and the third loan is for the remaining funds that are needed for the investment property. This can be with a different institution altogether because that loan is linked to the investment property whereas the first two are linked to your personal home.