Are you aware of exactly what a mortgage broker does?

In this article we show you how a mortgage broker works for you and what their role is.

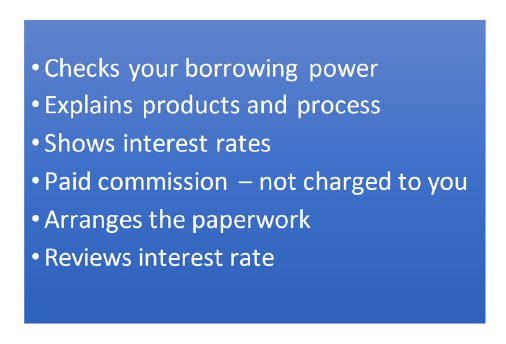

The first thing that a mortgage broker will do is show you how much you can borrow.

Secondly, they will explain the process of buying a property and applying for a mortgage, they will then take you through what interest rates are available from the lending institutions that they have on their panel (it’s important to note that brokers are paid a commission for introducing your loan to those lenders or the particular vendor that you’ve chosen).

Mortgage brokers are paid a commission from the bank’s profit, so it’s not a fee that you need to pay, and it isn’t added to your loan in any way, shape, or form so that you’re not penalized for using a broker.

Whether you went direct to that institution, or you dealt with a broker, you’re going to be getting the same line product at the same interest rate.

A broker will also handle the paperwork for you in lodging an application. We hope that this has been of value to you in understanding how a mortgage broker works.