Are you aware of what's involved in obtaining finance if you're self-employed?

You may have heard or may have experienced that it can be more difficult for people who are business owners or working for themself to be approved for a home loan.

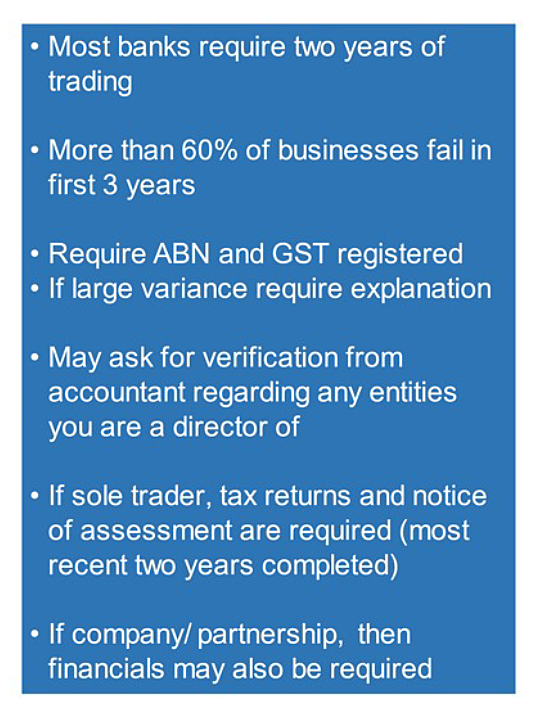

A recent study showed that the main reason for this is that more than 60% of businesses will fail within the first three years, especially small businesses. Give this, the banks want to make sure that if they’re going to lend to someone, who is self-employed, they can see a track record of consistent income.

This is what the banks look at and how the banks assess people who are self-employed.

If you’re looking to apply for a loan, the bank will usually want to see the last two years of financials or your trading history, to be able to see that you’ve been profitable and that you’ve had a consistent stream of income.

If you have experienced large ups and downs between the last two years, the bank will want a really good explanation as to why that is. They are most likely going to look at it more favorably if it’s trending upwards as opposed to the alternative, which is, you had a good year two years ago, but your more recent year has come down.